SBA 504 Refinance Rules: Understanding Eligibility and Benefits

Navigating the eligibility criteria for SBA 504 refinancing is essential for your business's financial health.

All you need to know about the SBA 504 Loan Program.

All you need to know about the SBA 504 Loan Program.

Navigating the eligibility criteria for SBA 504 refinancing is essential for your business's financial health.

504 Loans are a crucial financing option for businesses looking to acquire fixed assets.

SBA loans are a vital financing option for small businesses, offering diverse types and valuable benefits.

SBA loans provide essential financing options tailored for small businesses aiming to acquire, construct, or renovate self-storage facilities.

SBA loans are essential financial tools for small businesses, especially those looking to invest in real estate.

Government funding options are crucial for startups seeking financial assistance.

The SBA 504 Loan Program is designed to provide financing for small businesses looking to acquire major fixed assets

SBA loans provide essential financial support for cleaning businesses.

Business acquisition financing involves various methods to secure funds for purchasing a company.

SBA loans are designed to support small businesses, providing essential funds for various needs.

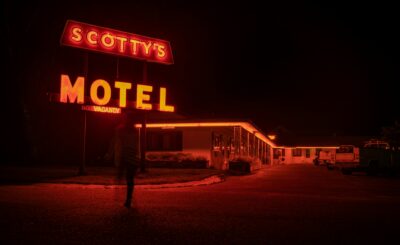

Motel financing involves assessing your financial situation and exploring loan options that suit your needs

The SBA 504 Loan Program is designed to support small businesses seeking long-term financing for significant fixed assets