SBA Loan for Cleaning Business: Funding Your Success in the Industry

SBA loans provide essential financial support for cleaning businesses.

Blog posts and podcast episodes organized to make it easy to access all you need to know how to successfully apply for an SBA 504 loan.

Blog posts and podcast episodes organized to make it easy to access all you need to know how to successfully apply for an SBA 504 loan.

SBA loans provide essential financial support for cleaning businesses.

SBA loans are designed to support small businesses, providing essential funds for various needs.

The SBA 7(a) Loan Program is designed to assist small businesses, including hotels, in acquiring the necessary financing to grow and thrive.

SBA loans are an excellent financing option for purchasing or expanding a gas station.

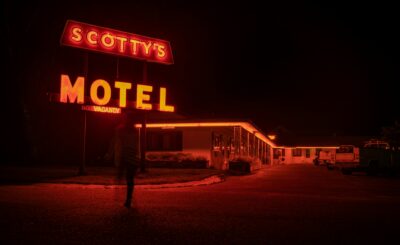

Motel financing involves assessing your financial situation and exploring loan options that suit your needs

SBA loans are a powerful tool for financing your laundromat business, offering favorable terms that traditional loans may not provide.

SBA loans, facilitated by the Small Business Administration, provide crucial funding for small businesses

In this episode of My SBA Loan Pro Podcast, Marc Camras reveals the blueprint for franchise owner success. Whether you’re considering franchising or already own a franchise, this discussion covers essential strategies—from choosing the right model to mastering long-term growth. Learn why franchising can outperform independent startups and how to avoid common pitfalls. If you liked this …

Join Ryan Smith, Principal and Founder of ThinkSBA and Attorney Scott Oliver with Lewis & Kappes as they delve into the intricacies of the SBA loan legal closing process, recent SOP changes, and the crucial role lender legal counsel plays in ensuring lender compliance. Gain valuable insights into Landlord Lien Waiver and Collateral Access Agreement, …

Bruce Marks has made a career out of mastering lower middle market business acquisition financing by leveraging the SBA 7(a) loan program coupled with a Pari Passu conventional loan for loan requests that exceed the SBA’s $5 Million borrowing limit. In this Episode Bruce pulls back the curtain revealing how to structure a Pari Passu …

Join Ryan Smith, Principal and Founder of ThinkSBA, as he sits down with John Homan, esteemed SBA Loan Workout Specialist. John shares valuable insights into the intricacies of SBA loan defaults, including how to avoid defaulting, how lenders respond to non-payment to mitigation strategies. Discover how to safeguard your assets, negotiate settlements, and overcome challenges, …