SBA 504 Loan Structure: Understanding Its Benefits and Requirements

The SBA 504 Loan Program is designed to provide financing for small businesses looking to acquire major fixed assets

The SBA 504 Loan Program is designed to provide financing for small businesses looking to acquire major fixed assets

Business acquisition financing involves various methods to secure funds for purchasing a company.

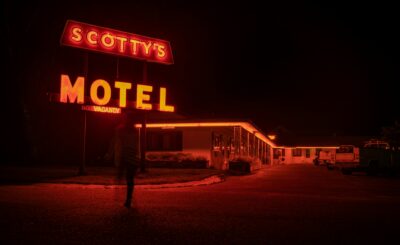

Motel financing involves assessing your financial situation and exploring loan options that suit your needs

SBA loans are a vital resource for coffee shop owners seeking funding for various needs.

SBA loans, facilitated by the Small Business Administration, provide crucial funding for small businesses

Roofing businesses often require financing to manage operations, acquire equipment, or expand services.

The CARES Act introduced critical provisions aimed at supporting various business entities during economic downturns.

In this episode of My SBA Loan Pro Podcast, Marc Camras reveals the blueprint for franchise owner success. Whether you’re considering franchising or already own a franchise, this discussion covers essential strategies—from choosing the right model to mastering long-term growth. Learn why franchising can outperform independent startups and how to avoid common pitfalls. If you liked this …

In this episode, Ken Rosenthal shares expert insights on why business owners should consider purchasing their commercial property and the best financing options available, including SBA 7a and 504 loans. Learn how owning your building provides stability, tax benefits, and long-term investment potential. Ken breaks down the differences between conventional loans, SBA programs, and other …

In this episode, Tim Malott, a seasoned M&A Advisor and Investment Banker, reflects on his journey from CPA and Bank President to Managing Partner of Shoreline Partners. With over 30 years of experience, Tim shares his approach to problem-solving, the nuances of selling privately held companies, and his commitment to creating an unreasonable value for …

Bruce Marks has made a career out of mastering lower middle market business acquisition financing by leveraging the SBA 7(a) loan program coupled with a Pari Passu conventional loan for loan requests that exceed the SBA’s $5 Million borrowing limit. In this Episode Bruce pulls back the curtain revealing how to structure a Pari Passu …

Join Ryan Smith, Principal and Founder of ThinkSBA, as he sits down with John Homan, esteemed SBA Loan Workout Specialist. John shares valuable insights into the intricacies of SBA loan defaults, including how to avoid defaulting, how lenders respond to non-payment to mitigation strategies. Discover how to safeguard your assets, negotiate settlements, and overcome challenges, …